Below are our frequently asked questions. For more information, please contact us for a consultation.

You can still get 2021 health insurance!

Due to the Covid-19 emergency, a Special Enrollment Period starting February 15 through May 15, is allowing individuals to enroll in a health plan. You can also enroll any time if you have certain life changes or qualify for coverage through Medicaid or the Children's Health Insurance Program (CHIP).

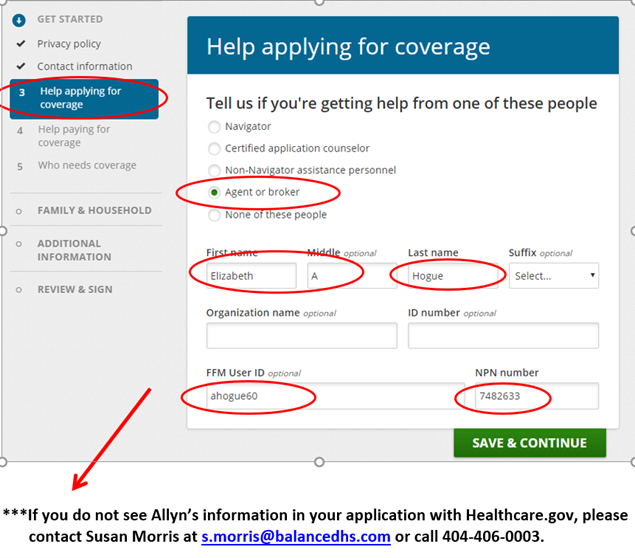

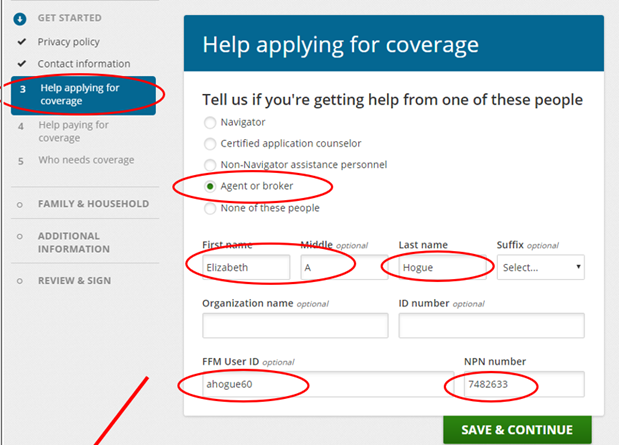

Elizabeth A Hogue FFM = ahogue60 NPN = 7482633

It does not cost you anything to use a broker! Most brokers who are certified by the exchange are also able to help you compare ACA-compliant off-exchange plans with the options available through the exchange. If your income is too high for subsidies, a broker who can help you shop on and off-exchange will be an excellent resource (this is especially true now that the cost of cost-sharing reductions is being added to premiums in most states - typically only to silver plan premiums, and often only on-exchange – ask your broker about this if you don’t qualify for premium subsidies). If you do qualify for subsidies, a broker can compare the exchange plans in your area and help you determine which one will be the best for your needs.

After you purchase a plan, the broker will continue to be your go-to resource when you have questions about your policy, network, or claims – and in our case, there’s never a charge for these services!

Brokers are paid commissions by the insurance company. You and your family pay the same price for coverage, regardless of whether you receive help from a broker or not.

Please enter: Elizabeth A Hogue FFM = ahogue60 NPN = 7482633

Please note that while you may have talked to Callie Osborne or Susan Morris (both licensed agents), our individual business is sold under Elizabeth Allyn Hogue’s NPN.

Upload client documents and view their status: Approved EDE partners provide the ability to view the status of your clients’ data matching issues and SEP verification issues and allow you to remotely upload supporting documentation to resolve these issues.

PREMIUM TAX CREDIT

The premium tax credit reduces Marketplace enrollees’ monthly premium payments for insurance plans purchased through a Marketplace. Health insurance plans offered through a Marketplace are standardized into four “metal” levels of coverage: bronze, silver, gold, and platinum. Bronze plans tend to have the lowest premiums but leave the enrollee subject to higher out-of-pocket costs when they receive health care services while platinum plans tend to have the highest premiums but have very low out-of-pocket costs. The premium tax credit can be applied to any of these metal levels but cannot be applied toward the purchase of catastrophic coverage. Catastrophic health plans typically have a lower monthly premium than other Qualified Health Plans in the Marketplace, but generally require beneficiaries to pay all their medical costs until the deductible is met. To qualify for a catastrophic plan, an individual must either be under 30 years of age or eligible for a “hardship exemption.”

COST SHARE SUBSIDIES

In addition to the premium tax credits, consumers may also be eligible for a second form of financial assistance — cost-sharing reductions. Cost-sharing subsidies reduce a person or family’s out-of-pocket costs, such as deductibles, copayments, and coinsurance, when they use health care services.

Unlike the premium tax credits (which can be applied toward any metal level of coverage), cost-sharing reductions are only available through a silver metal level plan.

Insurance companies in health care exchanges provide you with the 1095-A form. This form includes:

You will use this information to complete your income tax filing, adjust any tax credit payments, and claim any premium tax credits that may be due or are required to be paid back if too much advance premium tax credit was received during the year.